Co-authored by Khalil Shahyd & Lara Ettenson of NRDC This Update is cross-posted from the NRDC Expert Blog

The COVID-19 pandemic continues to disproportionately affect low-income communities of color and threatens to plunge our economy deeper into a recession at a time when many families and communities are already struggling to meet basic needs. The federal government should help by investing in solutions that support people without causing more pollution – such as energy efficiency.

With the right political will, energy efficiency investments can do this when programs are designed to equitably distribute benefits that reduce energy costs for those most in need, improve health, and get people back to work – all while eliminating harmful pollution by reducing the demand for fossil fuel energy.

This means continuing–and improving–federal efficiency programs, changing how funding is allocated, and adding critical conditions on federal aid (such as requiring specific hiring practices) to counter institutional inequities. The recent Moving Forward Act passed by the U.S. House of Representatives provides one such example of how federal investments can build social, economic, and environmental resilience through targeted policy to rebuild sustainably.

Our federal government should advance solutions that support people struggling during this crisis and actively combat the perpetuation of systems that disproportionately harm Blacks and other people of color, while providing an economic stimulus that will not burden our climate and health with additional harmful emissions.

How do we improve existing efforts?

Numerous federal efficiency programs can be enhanced to jumpstart the economy but they are woefully underfunded and require improvements to meet the growing need. They also should take into consideration the historic underinvestment in low-income communities and communities of color that has left buildings in disrepair and wasting energy. Efficiency programs also need mechanisms to address the ongoing employment barriers faced by these same communities.

Here’s how federal efficiency programs could be improved (more detailed recommendations are at the end of this blog):

- The Weatherization Assistance Program (WAP) provides services to seal and insulate homes for under-resourced households but only reaches 35,000 low-income households annually, a mere 0.1 percent of eligible participants, and has an extensive waitlist. Congress should dramatically increase funding to reach more low- and moderate-income residents, adjust various caps on spending to enable greater uptake, ensure services are also provided to multifamily buildings, improve cross-agency and utility collaboration to leverage multiple programs and provide the maximum benefit to customers, and ensure sufficient resources to train WAP providers.

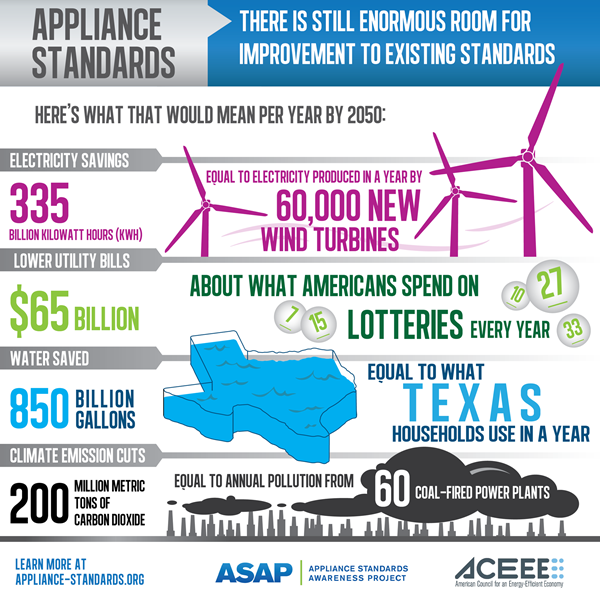

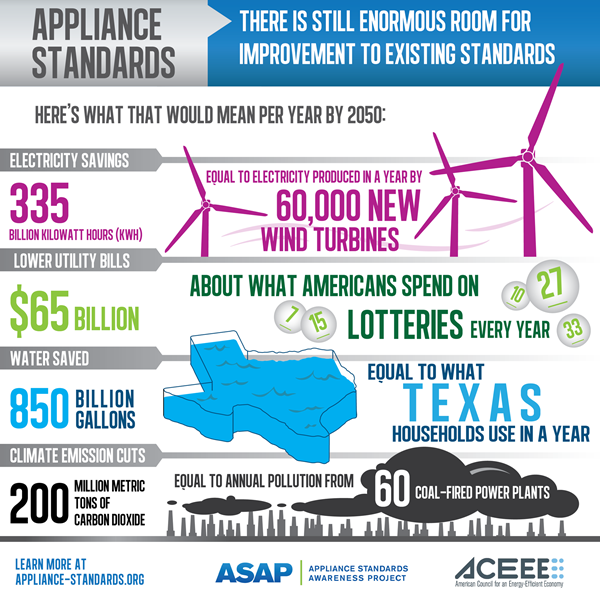

- National building codes and standards for appliances and equipment ensure that products and buildings use the least amount of energy feasible and provide efficiency benefits to all, such as cost savings and pollution reduction for every state. Clean energy advocates must defend against efforts to undercut efficiency standards and building energy codes while the federal government should continue implementing standards and provide resources to local governments to scale up compliance.

- The blue and white ENERGY STAR© label program administered by the government helps customers choose more efficient products and buildings, and leads to savings of more than $30 billion each year on consumer utility bills. The federal government must ensure ongoing funding for this program, prevent cheating that would undermine the efficiency of the certified products, and update building energy usage software.

- The federal government can also help state and local efficiency efforts via the State Energy Program (SEP) grants and by reauthorizing the Energy Efficiency and Conservation Block Grant (EECBG) program for localities to scale up efficiency, financing, and electrification programs in municipal buildings and eligible residential or commercial buildings.

- Federal small business loans or grants can support efficiency investments when targeted to those who need it the most and with rules that work for all types of businesses.

- Updated and expanded tax credits for builders, homeowners, and businesses would encourage efficient building practices and the purchase of high-efficiency products.

- The government should also create and fund new programs to accelerate retrofits, invest in the nation’s housing stock, and ensure that new buildings are highly efficient.

How else can we ensure equitable distribution of benefits?

These recommendations cover a handful of the existing programs that should be honed and expanded, but more can be done. Congress should establish programs to transform public housing, improve public building infrastructure, and provide rebates and other investments for housing retrofits. The federal government should also:

- Directly help people navigate the often-confusing application and compliance stipulations to receive funding.

- Include workforce requirements on public funding, such as requiring family-sustaining wages, local or targeted hires, and strong safety protocols including new standards to keep workers safe from COVID-19 exposure.

- Ensure funding comes with direction to protect tenants from displacement as building improvements could lead to unaffordable rent increases for residents.

- Invest in affordable and public housing stock and pair it with efficiency programs and tenant protections to encourage long-term reductions in energy burden.

Efficiency policies and programs must ensure equitable distribution of energy-saving opportunities, investments, and jobs. Not only can this help address historic inequalities, it will ensure that more people are served while helping to reduce economic hardships, improve quality of life, and avoid dangerous climate pollution.

Next Up: A closer look at utility customer-funded efficiency programs.

Additional Recommendation Details

- To improve the Weatherization Assistance Program (WAP) congress should:

- Refuse Trump’s proposal to eliminate the program and instead dramatically increase the WAP budget to reach more low- and moderate-income residents.

- Increase:

- Federal program spending to allow implementers to prepare for increased demand for services when pandemic safety can be assured.

- Administrative costs to 15 percent, allowing providers to scale up services and prepare for future projects.

- Solar options from $3,000 per dwelling unit to $10,000, leading to larger projects with more workers safely working outside of homes, followed by indoor efficiency upgrades when it is safe to do so.

- Average weatherization cost per unit spending to at least $10,000 to allow contractors to perform more work per home that would enable increased wages for returning workers, making weatherization and efficiency jobs more competitive.

- Improve cross-agency collaboration for federal weatherization, energy assistance, and affordable housing programs (e.g., the Department of Energy’s WAP; the Department of Health and Human Services’ Low Income Home Energy Assistance Program; and the Department of Housing and Urban Development’s affordable housing and means-tested grantmaking programs) to align eligibility requirements, target qualifying properties for low-income weatherization services, and ensure each household receives the most appropriate assistance from the various programs.

- Such collaboration should expand to state, utility, and other energy efficiency program administrators to leverage multiple offerings (e.g., efficiency, health, and home repair programs) to provide the maximum benefit to customers.

- Allow properties to receive weatherization improvements every 15 years.

- Allow WAP providers to continue paying salaries while work is suspended so as not to lose the workforce.

- Ensure services reach more multifamily buildings by clarifying available opportunities for their tenants, require the Department of Energy to report funding allocated to multifamily units by state, make service providers aware that WAP services can be applied to common areas, and require Community Action Agencies (which provide WAP services) to publicly report the type of housing served.

- Ensure local Community Action Agencies have adequate resources to train WAP providers.

- To protect national building codes and standards for appliances and equipment the federal government should:

- Stop blocking appliance standard development, implementation, and enforcement.

- Provide resources to local governments to adopt the most up-to-date building energy codes and train contractor and building officials to ensure enforcement.

- To protect the ENERGY STAR© label program, which cuts extensive energy costs through the more than 70 product categories and more than 5 billion branded sales since its inception, the federal government must:

- Ensure ongoing funding for the voluntary program that authorizes manufacturers to use the label for qualifying products.

- Maintain third-party certification processes to prevent cheating that would undermine the efficiency of the certified products.

- Increase funding to upgrade the ENERGY STAR© Portfolio Manager building energy management program to account for pandemic-related use changes, such as reduced occupancy due to working from home or shifted usage due to staggering occupants.

- The federal government can also help state and local efficiency efforts via the State Energy Program (SEP) grants and by reauthorizing the Energy Efficiency and Conservation Block Grant (EECBG) program for localities to scale up efficiency. These programs produced enormous benefits when they were well-funded. Past evaluations found that $4.2 billion in public investment led to more than $13 billion in energy cost savings and created about 200,000 job-years (one job sustained over one year). To benefit more people, the government should:

- Increase the opportunities for local governments to use funding for efficiency programs for eligible privately owned residential and commercial buildings, in addition to municipal infrastructure improvements like public buildings and street lighting.

- Broaden the scope to explicitly include financing programs and electrification of buildings and transport.

- Federal small business loans or grants can support efficiency investments when:

- Program rules are flexible and work for all types of businesses by offering different loan sizes and options.

- Delivery is targeted to the neediest small businesses, especially in under-resourced communities.

- Updated tax credits for homeowners and businesses will encourage the purchase of high-efficiency products. The government should:

- Expand credits and broaden eligibility for building owners to install efficient equipment or conduct upgrades.

- Update current credits for builders to construct energy-efficient homes that cut energy waste via advanced design.

- In addition to improving existing programs, the government should:

- Directly help cash-strapped individuals, small businesses, non-profits, and local governments with guidance and support to help apply for funding and comply with program stipulations.

- Include workforce requirements on public funding, such as requiring family-sustaining wages, local or targeted hires, and strong safety protocols including new requirements to keep workers save from COVID-19 exposure.

- Ensure that efficiency and clean energy programs do not accelerate tenant displacement, such as requiring federal programs to adjust projects and programs that could inadvertently lead to displacement and homelessness as higher rents due to building improvements become unaffordable to residents.

- Invest in affordable and public housing stock and pair it with efficiency programs and tenant protections to encourage long-term reductions in energy burden. This includes:

- Dramatically increasing investments in the Community Development Financial Institutions fund and the National Housing Trust Fund, with a carve out of funding for public housing.

- Raising funding for Housing Choice Vouchers, the Public Housing Operating Fund, Public Housing Capital Fund, and other housing assistance programs. Expand the Low-Income Housing Tax Credit program, which supports the construction and rehabilitation of affordable housing for low- and moderate-income renters.

- Increasing funding for the Indian Housing Block Grant program and other programs that support affordable housing on Tribal lands.